HARDISON’S TIPS – JULY 1, 2021 – July Fourth car shopping? Avoid these big mistakes (PT.1)

With Independence Day specials in full swing at car dealerships, it’s one of those times of the year when shoppers will flock to showrooms in search of a good deal.

If you plan to join them, do yourself a big favor: Do some legwork.

Despite a car being one of the biggest purchases that consumers will ever make, many people end up in showrooms without planning for the transaction. While things might go smoothly, it also could end up costing you more.

The average price of a car today is about $34,600. Exactly how much you’ll actually pay for any given model depends on the negotiated price and — assuming you finance the purchase — the terms of your loan.

The average amount financed is $31,020, according to recent data from Edmunds, an online shopping guide. The average auto loan length is 69.5 months — just shy of six years. Generally speaking, the longer the loan term, the more you’ll pay in interest.

Here are some big mistakes that can lead to overpaying for a car.

Telling the dealer your monthly budget

Sure, you need to know what you can afford on a monthly basis. However, if you go into a dealership with that number instead of the price you’re willing to pay for the car, you’re basically eliminating some of your ability to negotiate on the price.

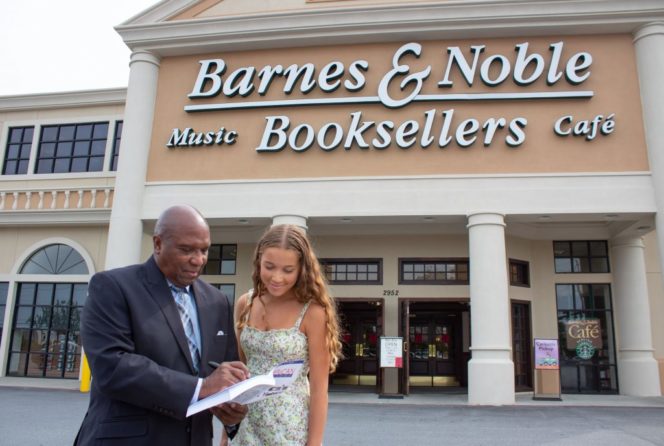

“You have to know what a fair price for the car is,” said Gary Guthridge, manager of the consumer lending portfolio at Navy Federal Credit Union. “The monthly payment is determined by the interest rate and terms of the loan.”

In other words, say you tell the salesperson you can afford $500 a month. You are shown a $31,000 car and told you can get a 72-month loan with a 5 percent interest rate and your monthly payment will be $499. Total interest would be about $5,000 over the course of the loan.

While the monthly amount would fit your budget, you could find out later that you could have gotten a better interest rate and that the car you bought typically sells for less than what you paid.

“Never tell the dealer what you want your payment to be,” Guthridge said. “Tell them what you’ll pay for the car and be willing to walk away.”

Not getting loan pre-approval

Before you even step foot in a dealership, you should secure pre-approval for a loan at the best interest rate you can find.

While many dealers offer their own financing, the rate might not be as good as the one you can get from a bank, credit union or other lender.

If the dealer rate is better, great. If not, you are prepared with the best rate available to you.

“If you don’t have that rate in your pocket to negotiate with, you won’t get the best offer from the dealership,” Guthridge said.