One only needs a few years of experience in the business world to know that the availability of adequate money or funding is a vital part of running a business. This could come at the start of the business as capital or the end of every business day as profits, bottom line is money is vital to running a business.

However, when money becomes scarce there are little options out there to turn to than to money lenders or loan agencies. If things get tough and you need to turn to a loan to dig you out, you had better keep your eyes peeled for these loan agencies and their tricky terms and conditions. All loan agencies are out to make a profit at the end of the day, sometimes by any means necessary including tricky means.

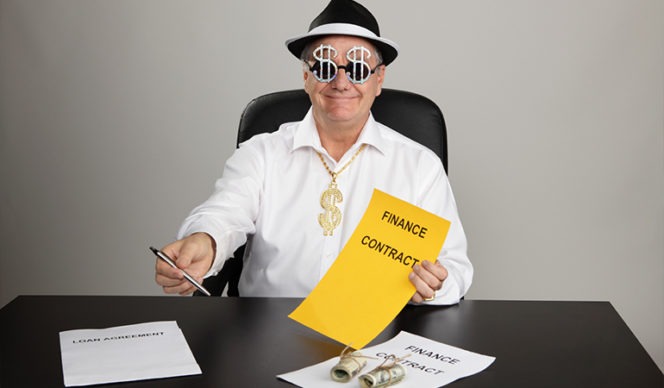

LOAN SHARKS

The term “loan sharks” is not a exactly a conventional word, but it is a term used to describe loan agencies or individuals in the practice of lending money to desperate borrowers. Sometimes the loan sharking is pretty obvious with noticeable high interest rates, even illegal. The kind of interest rates that accompany the loans from loan sharks leave little room for the borrower to fail with their investment. If you have put up some sort of attractive collateral, sometimes loan sharks let desperate borrowers get a loan just to have a go at their collateral.

Not all loan sharks hide in plain sight though. Jealous friends and neighbors can let you have a loan too with the bigger intention to wreck you. So here’s a tip if you want to know what loan sharks look like; they don’t all wear nice suits and big ties, they can be your friends you play golf with on holidays too.

HOW TO GO AROUND LOAN SHARKS

- Let your common sense come forth; don’t want stuff you can’t afford.

- Use budgets in your spending sprees

- Investigate loan agencies that are willing to let you have that loan easily and quickly.

- Avoid needing a loan in the first place.

- Look up a ton of loan agencies before settling for one.

- Engage a lawyer or attorney if the terms and conditions seem complicated.

- Keeping a savings account will be a good preventive practice in dealing with loan sharks.

Loan sharks are out there and while they can be really persuasive it is up to you to sign on the dotted line. The loan system has been very vital to the business world, especially for small businesses. So if you have to take out a loan do so while keeping your eyes peeled.

Leave a Reply