Automotive companies range from cheap to pricey worldwide. This reflects both the challenges of legacy automaking and the market’s optimism for transformation’s future beneficiaries. In recent months, automotive start-ups have been subjected to a hard valuation reality check, and the SPAC funding channel has almost been closed off. Due to uneven technological progress in the supply chain in the next several years, more capital may be transferred. This hasn’t changed the long-term outlook for electrification. In the meantime, near-term currency volatility is hurting US automakers.

The automobile sector is the most controversial

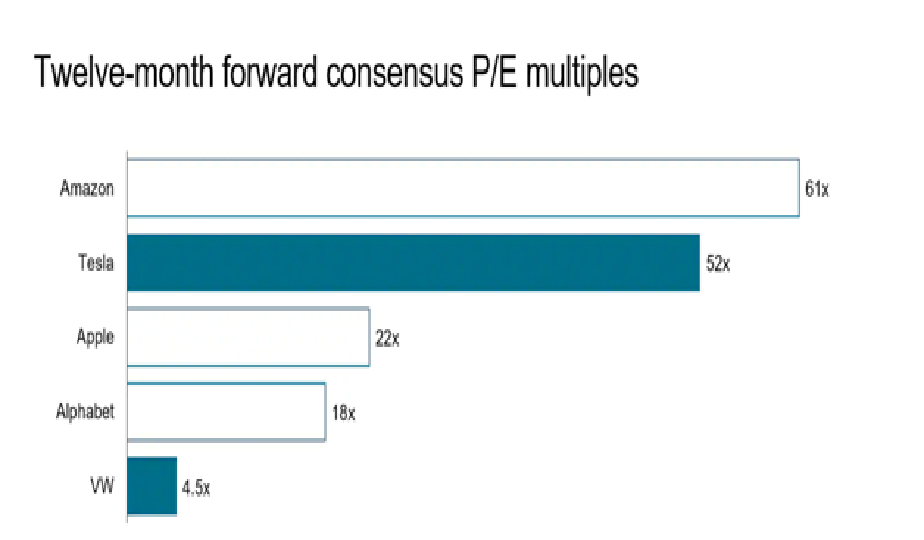

Automobile production has both the world’s cheapest and most expensive publicly traded companies. Volkswagen trades at 4.5 times its expected 2022 earnings. At the opposite end of the range are technology-focused electric vehicle manufacturers like Tesla, for which this statistic is 52 times (compared to Alphabet’s 18x, Apple’s 22x, and Amazon’s 61x), as well as different start-ups that have not yet attained profitability.

Legacy car valuations reflect challenges

Volkswagen has traded cheaply relative to earnings for many years. Many causes Profitability is poor relative to capital requirements. Due to inventory requirements and the need to pay (and underwrite) supplier and dealer network risks, balance sheet risk is considerable. In economic downturns, this increases bankruptcy risk. The new crop of startups claims to solve many of these issues. Low mechanical complexity equals less capital and simpler supply networks. Fewer repairs mean fewer traditional dealers and fewer stocks. Being electric-only enables them.

The valuation gap is due to growth expectations

The growth disparity explains the valuation discrepancy well. Year-to-date, global battery electric car sales are up 68%, while total light vehicle sales are down 13%. Legacy manufacturers’ access to this potential is limited because even BEV transition leaders like BMW and VW have around 6% BEV in their sales mix. In the end, legacy automakers are struggling to defend a $2.5tn industry, while young automakers have little to lose.

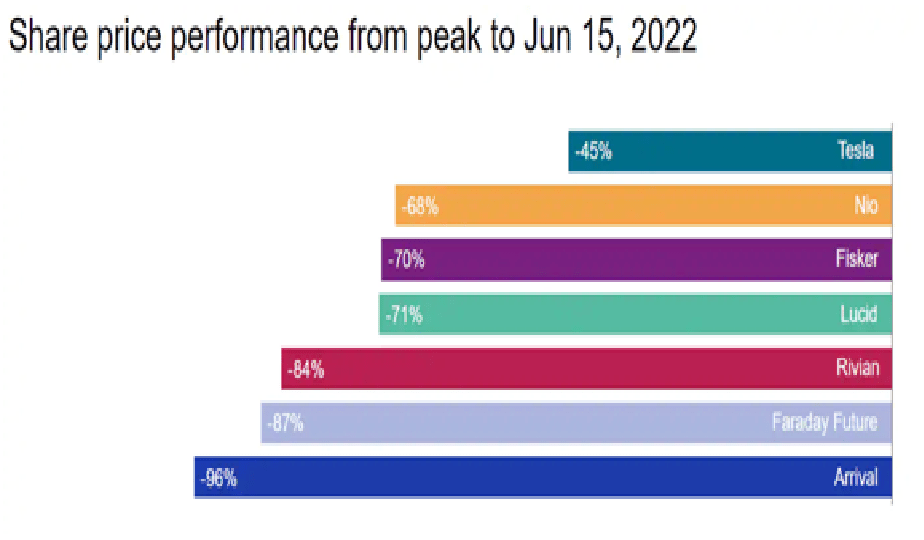

Investor enthusiasm for new cars has decreased

New automaker valuations have changed sharply in the past year. In the figure below, electric carmakers’ current market values are compared to their peaks. This is partially macro-driven. Global economic circumstances have deteriorated, with GDP decreasing, inflation rising, and less demand for risky investments. The key shift may be growing recognition of the difficulty of starting and developing auto production from scratch.

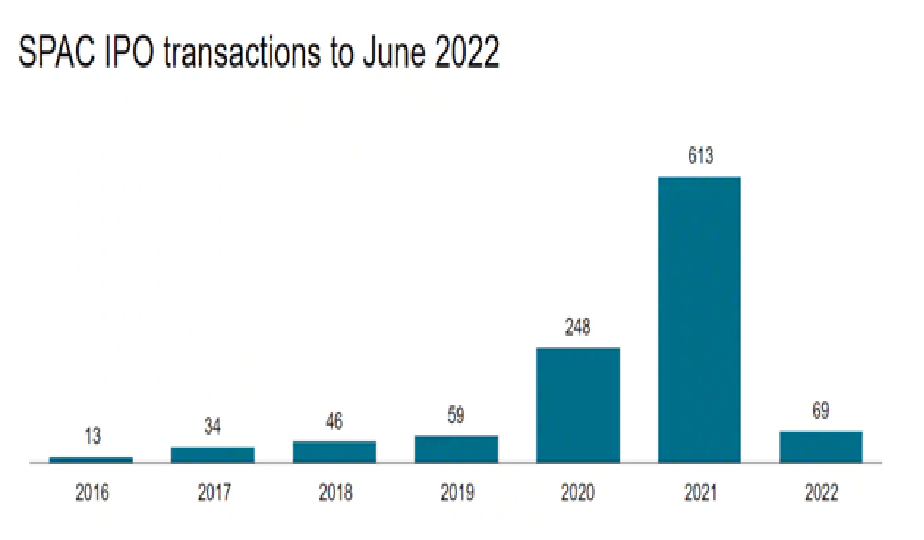

Financing route closed

69 SPAC (special purpose acquisition company) transactions have been completed so far in 2022 compared to 613 in 2021. In 2021, Fisker, Polestar, Lucid, and Arrival went public via a speculative “blank cheque.” Now, companies wanting to follow in their footsteps will face tougher financial scrutiny.

Uneven change

Early market excitement hasn’t been replaced by reality. The expansion of BEVs and the fall of ICEs will be the industry’s most crucial change since its beginning early last century. It won’t be smooth. A “bumpy” change will affect innovation, vehicle development, system sourcing, manufacturing dynamics, retail interaction, and the aftermarket. This is a virtually unknown area. Transition speed, stakeholder commitment (consumers, government, dealers, etc.), upstream battery raw materials, altered logistic streams, consumer acceptance/education, and a new service dynamic cloud the sky. The existing ICE-focused environment took over a century to develop; expect a dramatic upheaval in the next decade.

Capital displacement is anticipated across the ecosystem

There is a threat of capital migration at every step of the ecosystem. Example: component suppliers. Several suppliers operating in BEV-disappearing system areas are faced with essential questions regarding the direction of future innovation and reinvestment, as well as the value addition to vehicles. You have several options: you can do nothing and let the volume fall naturally, you can pivot and concentrate on BEV systems, you can double down and become a consolidator in a market that is shrinking, or you can sell the operation. Different timelines are involved in the process of displacement. There will be winners and losers as a result of the transformation.

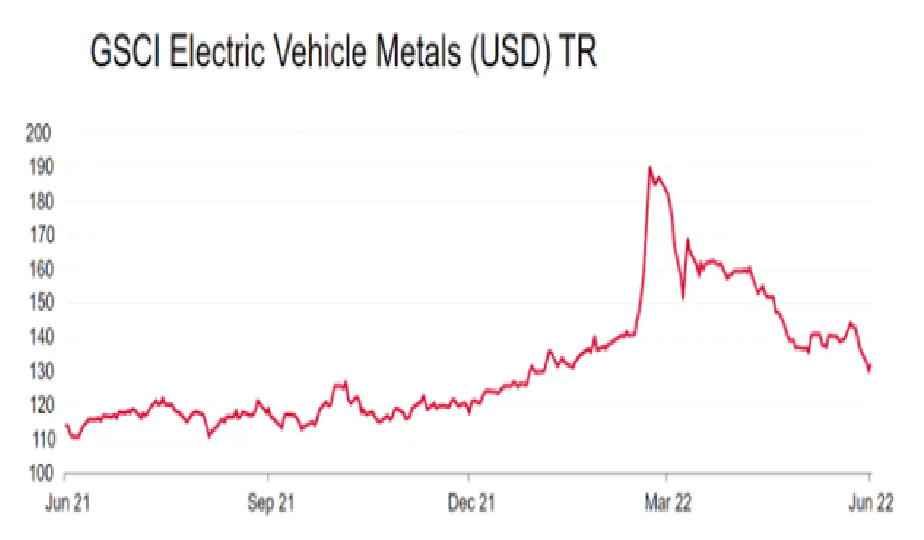

Nothing has stopped the electrification process

Does this suggest electrification won’t happen or will happen slower despite ecosystem shifts? There’s little sign of fundamental shifts. The post-Ukraine increase in battery raw material prices has subsided, and high gasoline prices support BEV ownership costs. The EU parliament voted in early June to ban new internal combustion sales from 2035, subject to agreement from Germany and other opponents.

Frequently asked questions:

What type of market is the automobile industry?

An excellent illustration of an oligopoly is the US automobile sector. It mostly comprises General Motors (GM), Ford, and Chrysler, three enormous companies. Prices, as well as the creation and launch of new automobile models into the American auto market, are affected by this oligopoly.

What does the automobile sector include?

All businesses and endeavors are concerned with the production of motor vehicles, including the majority of their parts, such as their engines and bodies, but omit their tires, batteries, and gasoline.

Why automobile industry is capital intensive?

Due to the significant capital costs faced by enterprises in the industry, the automobile sector is regarded as being particularly capital-intensive. Compared to the price of labor or raw materials, property, plants, and machinery make up a significant portion of the company’s expenses.